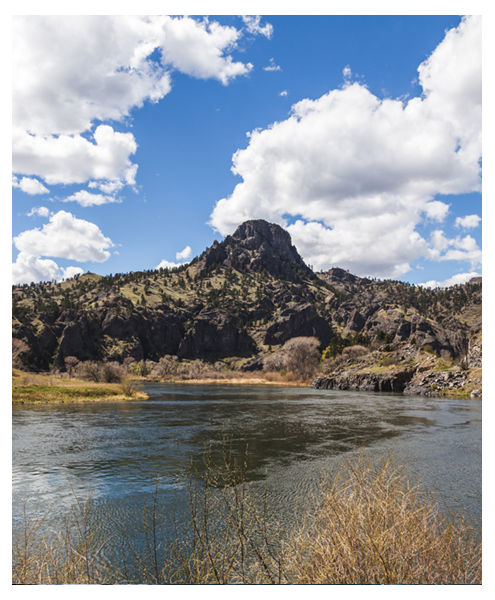

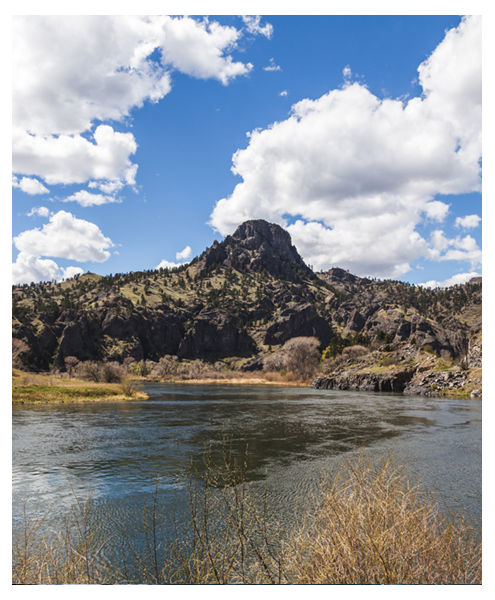

PJ Popham

Your Great Falls

Home Loan Expert

When you’re ready to build, buy, or refinance your home, you deserve the utmost care. PJ Popham brings passion and expertise to help you on your mortgage journey, especially with first time homebuyers and conventional loans.

A Loan Expert by Your Side

Pacer, a native of Great Falls, Montana, began his journey in the mortgage industry on February 26, 2024, inspired by fellow Loan Officer and mentor, Steve Thurston. Rooted in his hometown, he has called Great Falls home for most of his life.

Pacer is renowned for his honesty, transparency, and direct approach, he earns the trust and appreciation of his clients, emphasizing the importance of strong relationships in achieving success. He values the connections he builds with colleagues, clients, and vendors, considering them invaluable to his profession.

Notably, Pacer’s significant client relationship led him to meet his fiancée, Katie, whom he assisted in purchasing three cars. Together, they share two children, Owen and Heather, and a mutual love for dirt track racing, often seen competing at Electric City Speedway. Pacer remains committed to philanthropy, having supported the United Way during his time at Bison Ford.

Testimonials

See what everyone is saying about PJ

★★★★★

4.9/5 Rating | 16K Reviews

Get Started in Less Than

10 minutes

Get pre-qualified with PJ with our online mortgage application. It's simple, fast & secure.

Local Home Loan

Expertise & Service

Our most popular loan options

By far, the most popular type of home loan. Borrow up to 97% of the home’s value. Private mortgage insurance required for down payment of less than 20%.

Designed to help borrowers with low-to-moderate income or low credit purchase a home. Down payment as low as 3.5% and available to those with low credit scores.

MannMade construction and renovation loans exclusively through Mann Mortgage. 0-5% down payment, lock in the best interest rate, monitor construction spending online, and save time and money with a one-time close.

Available to assist active service members, veterans, and surviving spouses in buying, building, and retaining a home. 0% down payment and properties must meet VA guidelines.

Refinance to get a lower rate, get cash out, shorten your term, or change the type of loan you have.